Seller Discretionary Earnings (SDE) has become the unofficial language of small business transactions across Canada. Whether you’re a first-time buyer exploring your options or a seasoned operator preparing for a strategic exit, SDE is the most important number in the room. It goes beyond net income, offering a clearer picture of the true earnings a new owner can expect to retain from day one.

Unlike more complex accounting metrics used in institutional M&A, SDE was built for main street business deals. Its purpose is simple: normalize the earnings of a business by removing owner-specific and non-recurring expenses, then add back the compensation of the owner-operator. The goal is to show how much income a hands-on owner could reasonably expect if they were to run the business themselves.

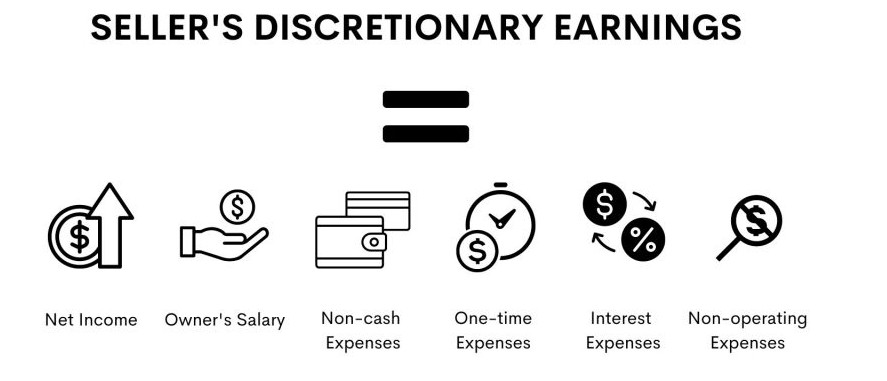

Breaking Down the SDE Formula

SDE starts with net profit and then adds back the following:

-

Owner’s salary or compensation

-

Depreciation and amortization (non-cash expenses)

-

Interest expense (as financing structures vary)

-

One-time or non-operational expenses (e.g., legal settlements, COVID relief write-downs)

-

Personal perks (e.g., vehicle leases, travel, meals)

For example, a landscaping company in Alberta may report $80,000 in net profit. But after adding back the owner’s $60,000 salary, $10,000 in amortization, $4,000 in interest, and $6,000 in personal vehicle use, the SDE is $160,000. That’s the number buyers will look at when evaluating the income potential and purchase price of the business.

Accuracy is critical. Sellers must document each add-back with receipts, invoices, and a clean general ledger. Buyers should conduct detailed due diligence to verify these adjustments. Inflated or unjustified SDE figures can derail negotiations and damage credibility.

SDE as the Foundation of Valuation

The vast majority of small businesses listed for sale in Canada are priced using a multiple of SDE. Most transactions fall within a 1.5x to 3x SDE range, depending on the business’s size, industry, geographic location, risk profile, and cash flow predictability.

A recurring revenue business, like a janitorial service with multi-year contracts, may fetch 2.8x SDE due to its stability. In contrast, a business tied to a single seasonal market, such as a tourism outfit in the Maritimes, may land closer to 1.6x due to cyclical income.

Lenders also rely on SDE when underwriting small business acquisition loans. Canadian banks and private financing firms often use a debt-service coverage ratio based on adjusted SDE. A business with $200,000 in SDE is generally expected to cover annual loan repayments comfortably in the $100,000–$130,000 range, leaving room for reinvestment and owner compensation.

Why SDE Resonates with Canadian Entrepreneurs

Seller discretionary earnings is not just a number—it’s a proxy for lifestyle. Entrepreneurs want to know what they’ll take home after stepping into the owner’s shoes. SDE strips out the noise of accounting treatments and owner-specific tax strategies to reveal usable, spendable income.

It also facilitates clearer negotiations. A buyer can model scenarios by deducting projected manager salaries or marketing reinvestment from the SDE to see adjusted take-home potential. This flexibility makes SDE especially valuable in owner-operated businesses under $5 million in revenue, where individual effort and operational control directly affect profit margins.

On the sell-side, a strong and well-documented SDE can significantly improve listing performance. Buyers want to see consistency, explainability, and room for growth. If a business shows three years of stable or rising SDE, with low customer concentration and clean books, it will likely command multiple offers—and a premium multiple.

SDE’s simplicity is what gives it strength. It acts as a common denominator across industries and ownership models, allowing buyers and sellers to have aligned expectations. While it doesn’t replace full financial analysis, it serves as the most accessible and actionable indicator of business health and transferability in the Canadian small business market. If you are looking for businesses in a variety of places in the Canadian market, check our homepage here.